01 Nov Our investment managers’ views on the pandemic in 2020

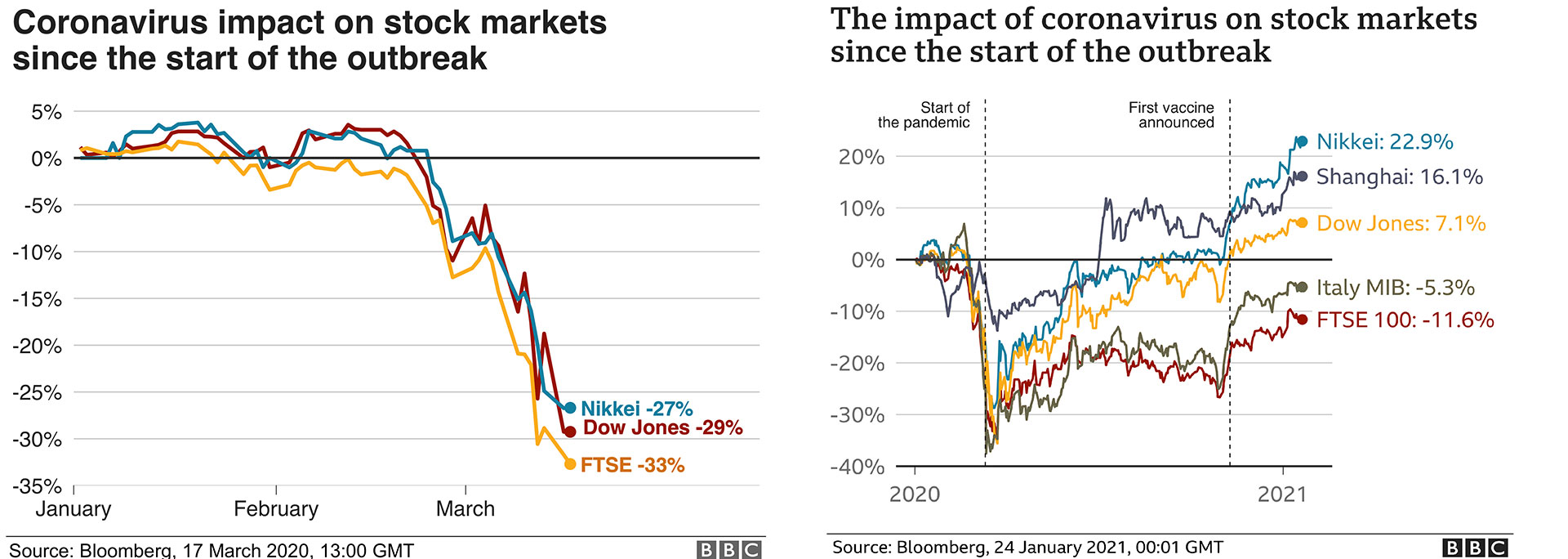

In March 2020 we wrote two articles around the financial turbulence caused by the on-set of the Covid-19 pandemic. While at the time of writing (in late 2022) the markets have settled and the pandemic, for many, is considered over, we thought it relevant to keep our thoughts on our website for future reference. We can now see how the financial markets reacted when the WHO announced the crisis, to when the first vaccines were released. (Source: BBC) This gives you an idea of the state of mind of our investment managers as well as our pension holders at that unique time of uncertainty. Of course the war in Ukraine and other factors have has a second impact on markets, but our ‘upbeat’ view at the time of how the markets would react has been proven correct.

![]()

10 March 2020 – The Financial Turbulence Due to Coronavirus

Global share markets have fallen hard in the past few weeks due to the Coronavirus pandemic. Understandably, this may cause feelings of uncertainty and worry about your investments and your pension. Consulting with a pension transfer specialist could enlighten you on the situation and help you make informed decisions on what to do with your money in this time of financial turbulence.

Your pension fund is a long-term investment, and if that is linked to the volatile markets, significant falls may impact its value. However, it may be challenging to predict the longer-term impact of Coronavirus on financial markets.

Markets are typically concerned with the impact of Coronavirus on economic activity. Restricted supply chains and travel may cause falling prices as these are likely to affect short-term trading performance. While this may negatively impact investors, it is not the best way to predict a long-term or a medium-term slowdown. Demand may also be affected for months, but it should return once the outbreak is under control.

A pension transfer specialist may recommend ensuring that your investments are efficiently diversified throughout the world, so you have a cushion in case any single region experiences a heavy fall. A mix of assets ranging from funds and shares to cash and bonds across different geographies and sectors can help ensure that market volatility during this time doesn’t bring your entire portfolio down.

The UK economy may be challenged by the Coronavirus, but financial institutions and banks are doing their part in assuring their customers. For instance, the Bank of England has declared an emergency package of measures ahead of the UK Budget in an effort to contradict cash flow issues, which many UK households and businesses are likely to face in the coming months. Global policymakers are also taking action, and along with favourable valuations for any risky asset class, you may be assured of comfort in a moderate pro-risk investment strategy. However, your pension transfer specialist may recommend ensuring a resilient portfolio against any downside situation.

20 March 2020 – Professional Investment Managers’ Views on Coronavirus

There is no denying that the global Coronavirus pandemic has significantly impacted the global financial market. The UK share index (FTSE), for instance, declined by 16 percent over the week by March 12, and by 27.5 percent when you consider its performance in February 2020. Within the same time frame, the S&P also declined by 17.7 percent and 26.5 percent. These declines may be alarming to investors, so professional investment managers, including pension financial advisors are sharing their views and welcoming personal one-on-one consultations with their clients who may be concerned about their pension portfolios.

Knowing the views of professional investment managers and your pension financial advisor on the Coronavirus may provide you with some reassurance about the health of your finances. Notably, most financial experts believe that much of the media and the available market commentary on equity markets are associated with short-term movements in the market. Pension funds, however, are long-term investments, and despite the lack of a guarantee, history has proven that market volatility can improve over time and that the markets can recover invariably.

Your pension financial advisor will likely tell you that determined that a diversified portfolio can offer some protection and serve as a cushion against the impact of declining equity markets. That said, investment managers may recommend having a diversified portfolio that is tailored to your risk profile in the longer term. If you think that your risk profile evolved, get in touch with your financial advisor for a discussion. Long-term investors are encouraged to look at the bright side. Even if the virus brings the world economy to a recession, they are expecting economic activity to bounce back later, and additional factors could make it stronger.

Besides the Coronavirus, there are other factors that have impacted the markets around the world. These include US border closure to European flights except for the UK, and the oil price conflict between Russia and Saudi Arabia. The Coronavirus may be the underlying reason, but those factors led to more negative market sentiments these days. Professional investment managers expect the outbreak to affect consumer spending and industrial production.

Your pension financial advisor may offer some tips on how you can act and what you can do in times of uncertainty. Do not hesitate to get in touch with them for assistance.